Safeguard asset value with financial and carbon risk monitoring

Automate risk assessment with ESG data collection and calculations

A single data layer for consolidated risk exposure

Tenant Risk Intelligence

BuiltAPI connects your asset management systems directly with financial and risk intelligence platforms like Dun & Bradstreet, Moody’s Analytics, and RCA, bringing credit and market risk insights into your daily operations. By linking tenant data with external credit scores and exposure models, BuiltAPI helps real estate managers monitor tenant default risk, assess portfolio vulnerability, and make informed investment decisions.

Browse Datasets

Enriched with ESG and Environmental Data

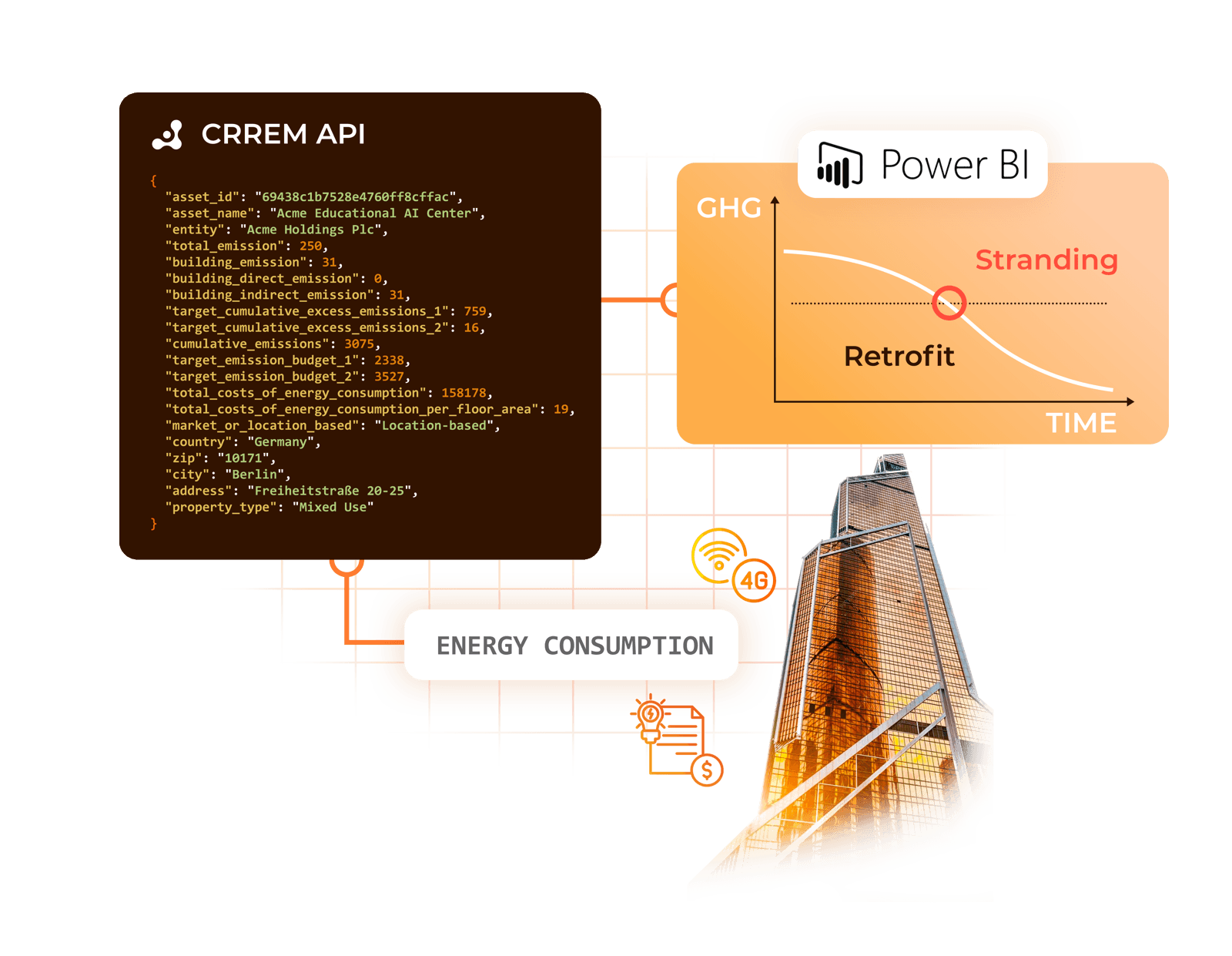

CRREM API by BuiltAPI brings science-based carbon risk modeling into your software stack via REST API. Enriched with environmental risk scores by Munich RE, it helps real estate platforms assess financial exposure to climate risks and align with ESG standards like GRESB and regulations like SFDR, while keeping compatibility with spreadsheets like InREV SDDS.

Explore Connectors

Relevant App Connectors